The Takeaway: Learn how a flood administrator expanded her program’s reach by training local real estate professionals on flood risks, flood maps, and flood insurance.

Overview

Learn how Lisa Foster, the Pinellas County flood administrator, and her team developed a training program for real estate professionals that builds their awareness about flood zones and flood insurance, and provides the right tools to inform potential buyers. The county participates in the Community Rating System and has developed the customized Pinellas County Program for Public Information (PPI) to create a better-informed community, and to help flood insurance policyholders save money.

Lessons Learned

- Cater to your audience. Real estate professionals are in an ideal position to educate potential residents about flood risks—and how to protect their investments. Additionally, these professionals understand the benefits of relaying flood information to their clients. Lisa recognized the value they could provide and the ways to maximize their reach.

- Identify the right tools for your audience. Lisa and her team worked with several agents, using their interests and input to give them the tools they would need to learn more about the subject matter and, as a result, do their jobs more effectively. The team then developed resources, including the Flood Map Service Center, realtor training, and flood awareness materials, that agents could use with their clients.

- Work with groups that expand your reach. Real estate professionals are working together to help the county and its municipalities increase flood risk awareness. The agents are the perfect conduit to potential buyers and investors for this type of information, and the training helps arm them with the knowledge they need to answer buyers’ questions.

- Look for an existing process or program to help you get organized. Lisa and her team used the Community Rating System as a guide in developing their activities under the Pinellas County Real Estate Disclosure Program, which they implemented via their Program for Public Information. The Community Rating System also provides a financial incentive for flood insurance policyholders through reduced premiums.

The Process

Initiating Flood Risk Outreach

Lisa Foster, the Pinellas County flood administrator, has been instrumental in helping her county’s National Flood Insurance Community Rating System program identify areas for improving documentation of existing activities, as well as opportunities for new projects.

“The county was doing great things to reduce their flood risk and ensure a safe community, but there was an opportunity to develop some documentation to request additional Community Rating System credit, which equates to reductions in flood insurance premiums for policyholders,” Lisa says.

Lisa and her team also identified the Program for Public Information (PPI) as a new activity to help streamline and improve upon the wealth of existing flood outreach being implemented across departments and in other organizations. As part of the program, a community can get rating system credits for local activities that advise people about flood hazards, flood insurance, and protection measures. These activities can be directed toward floodplain residents, property owners, insurance agents, real estate professionals, or other segments of the community.

During the kickoff for the Program for Public Information, the committee discussed where to focus outreach efforts. Tom Shelly, a real estate professional and commissioner for the Town of Belleair, Florida, noted that real estate agents are not very aware about flood zones and flood insurance. Real estate professionals, he said, would be a great group of people to work with to help spread the message. “Real estate agents,” Lisa points out, “are in an ideal position to inform buyers about whether a property is in a flood zone and if flood insurance is required.”

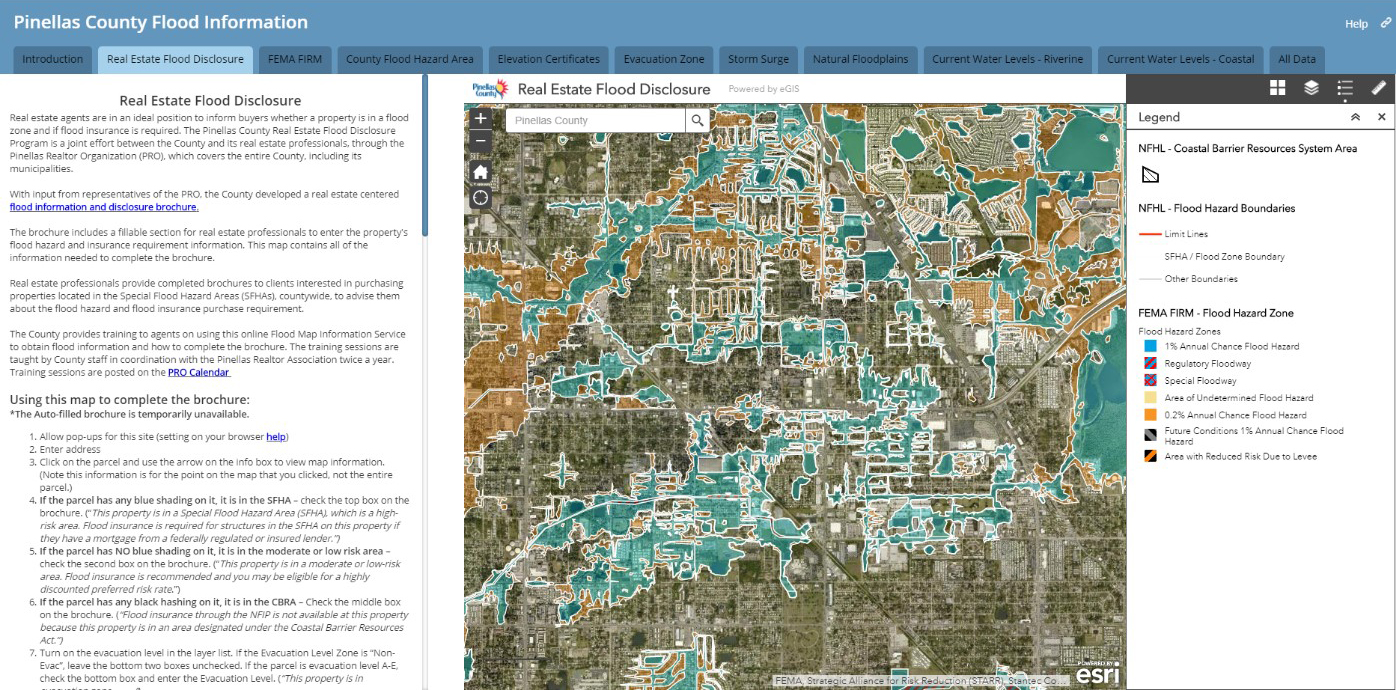

With input from the program committee, which included staff members, residents, real estate and insurance professionals, and other stakeholders, Lisa and her team started the Real Estate Flood Disclosure Program, and developed the Pinellas County Flood Map Service Center.

While the tool can educate everyone in the community about their flood risks, the team developed a special section specifically for real estate professionals. With it, they can see if the properties their clients are interested in buying or selling are in a FEMA Flood Insurance Rate Map high-risk flood zone, where flood insurance is required for properties with a mortgage from a federally regulated or insured lender. They can also see if the property is susceptible to flooding from storm surge, or is in a coastal barrier resource area where flood insurance may not be available, and what evacuation zone it lies in.

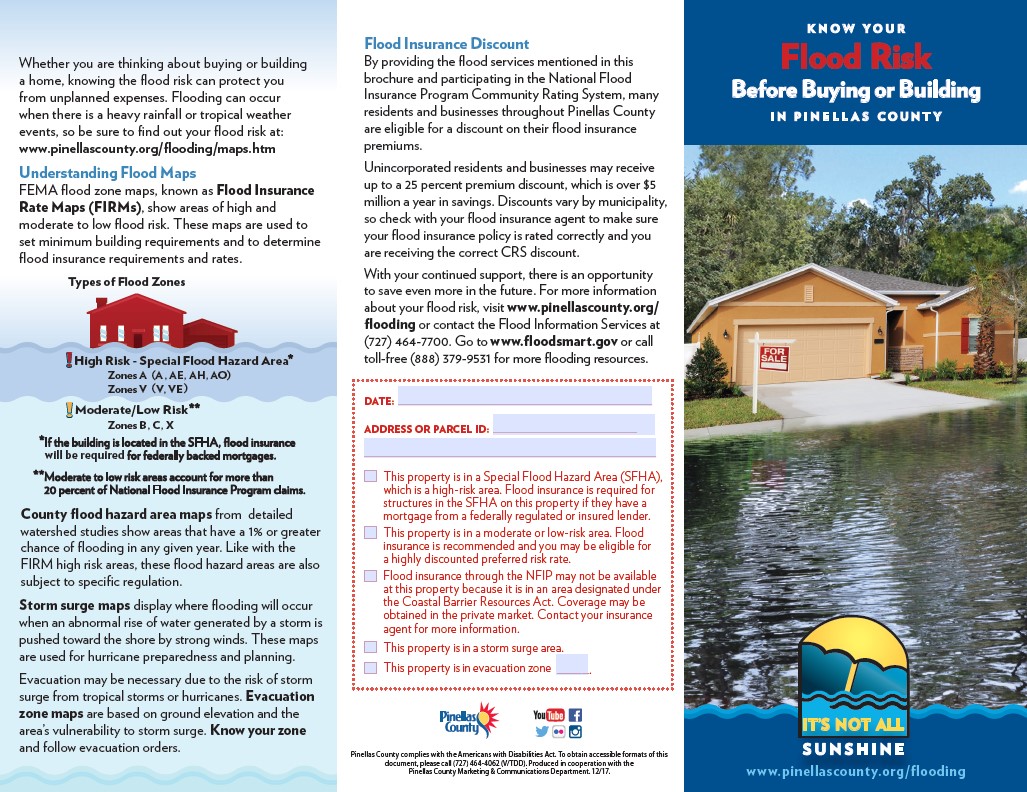

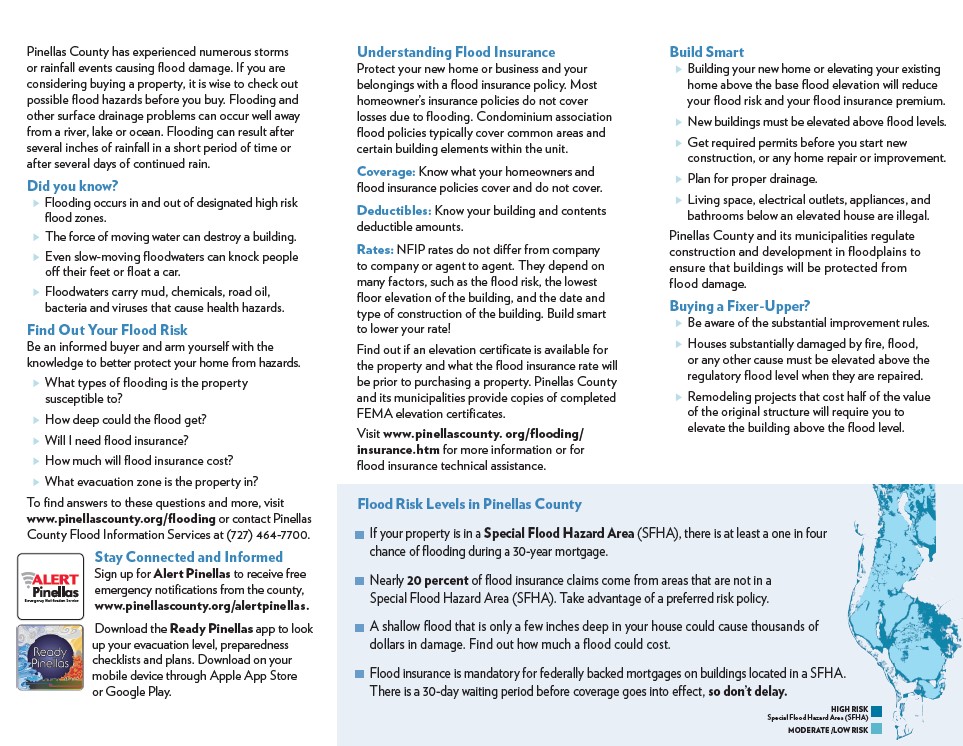

Next, Lisa worked with the program committee and county staff to develop a brochure to accompany the Flood Map Service Center, called "Know Your Flood Risk Before Buying or Building in Pinellas County."

The brochure provides information on a property’s potential exposure to flooding and storm surge, and indicates if flood insurance is required for financing—serving as a tool that agents can easily customize and share with potential buyers.

Real Estate Agent Training

Once the resources were developed, Lisa coordinated with the Pinellas Realtor Organization to provide at least two Flood Disclosure and Map Training for Real Estate Professionals classes per year. The first half of the training covers basics, such as defining different types of flooding (rain, surge, clogged drainage pipes, for example), flood zones, flood insurance and the Community Rating System, and floodplain development building.

The second part of the training is hands-on. “I want to get the agents in front of the Flood Map Service Center,” Lisa says, “so they feel comfortable looking at flood maps and understand what the maps show.”

During the hands-on portion, agents have a worksheet they complete using the Flood Map Service Center. Agents practice using the existing flood maps to see if a listing is in a high-risk flood zone, moderate-risk flood zone, coastal barrier resource area, storm surge zone, or evacuation zone. They also use maps to check if the property is near wetlands or protected floodplain, has an elevation certificate, or has significant flooding potential, as well as if the property has all the Flood Insurance Rate Map information to complete an elevation certificate.

To make the training fun, Florida Floodplain Managers Association (FFMA) representatives attend and provide small prizes, such as FFMA cups, to participants who answer Lisa’s questions correctly. The two classes are capped at 100 participants each—but the interest always exceeds the maximum capacity—and Lisa hopes to be able to add more classes in the future.

“They want more,” she says. “They ask for more brochures to give to potential buyers, and they have so many questions.”

The real estate professionals’ questions, along with their requests for more trainings, have helped Lisa adapt the training to focus more on flood insurance and building regulations. The Program for Public Information insurance professionals, who serve as flood insurance advocates for the county, are also invited to the trainings to assist attendees with technical insurance questions. They provide residents and businesses with this technical assistance at no charge, which, with proper documentation, is eligible for Community Rating System credit.

Lisa says the reason most agents are so receptive to the training is that they want to be knowledgeable about the properties they are selling. Buyers are becoming more aware of flooding and flood insurance, and look to their agents for answers. Agents, in turn, want to be a credible source of information, and having this information about flood risk helps their business. Participating agents provide Lisa with letters stating that they are distributing brochures to their clients, which is a requirement for obtaining rating system credit.

Outcome

Next Steps

Lisa and her team are working with local communities, the Pinellas Realtor Organization, and program participants to compile documentation each community in the county will need for its Community Rating System verification visit. Lisa and her team are also finalizing updates to the full-day training, improving the Flood Map Service Center with additional parcel information, automating flood information reports, exploring how real estate agents can get continuing education credits, and continuing to conduct flood risk and awareness outreach.

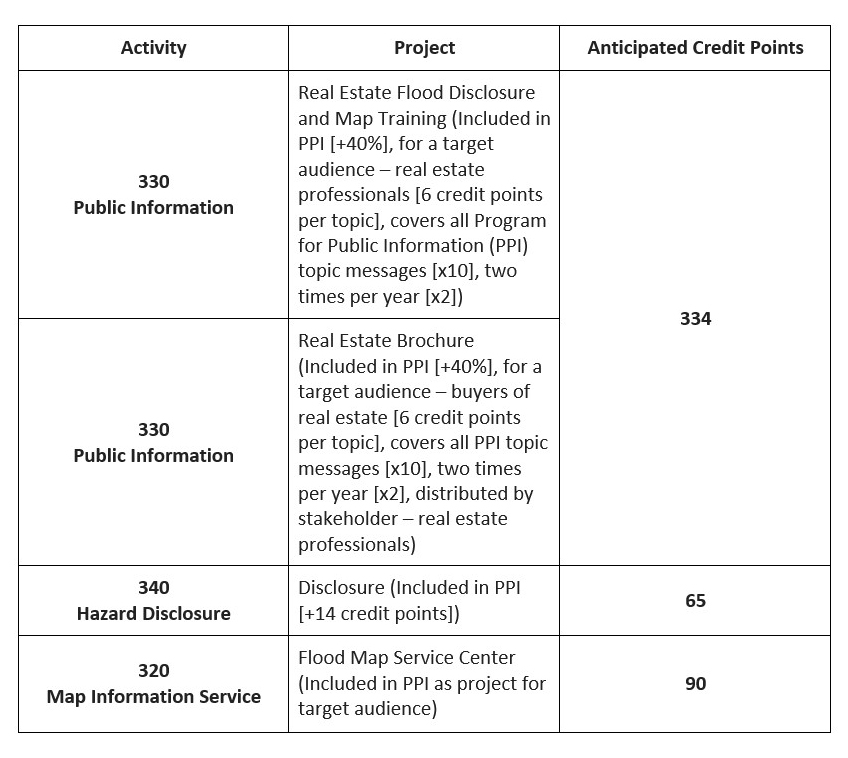

Potential Community Rating System credit points from real estate professionals’ training and outreach activities in Pinellas County